Dear Mutual Fund investors To say the Hindenburg report wreaked havoc in the Indian markets would be an understatement. Ever since the war of words began between Asia's richest man and the American investment research firm, investor malaise around anything Adani left the conglomerate bleeding.

However, controversies aside, what investors want to know is whether they should be scared. While those who have directly invested in the Adani group stocks did so on their own accord, what about those that took the mutual fund route?

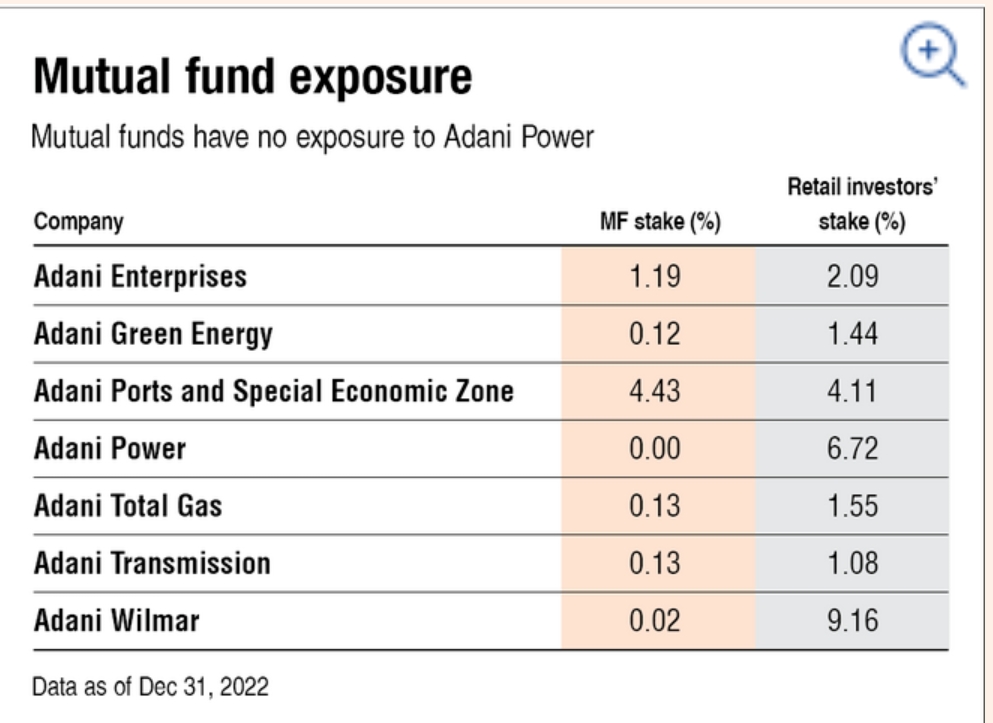

Most-bought Adani group stocks by mutual funds

A total of 154 funds are exposed to Adani group stocks, of which 107 are passively managed (index funds and ETFs), and the rest are active.

However, actively managed funds have been invested only in Adani Enterprises, Adani Total Gas, and Adani Ports & Special Economic Zone of the seven listed Adani group companies.

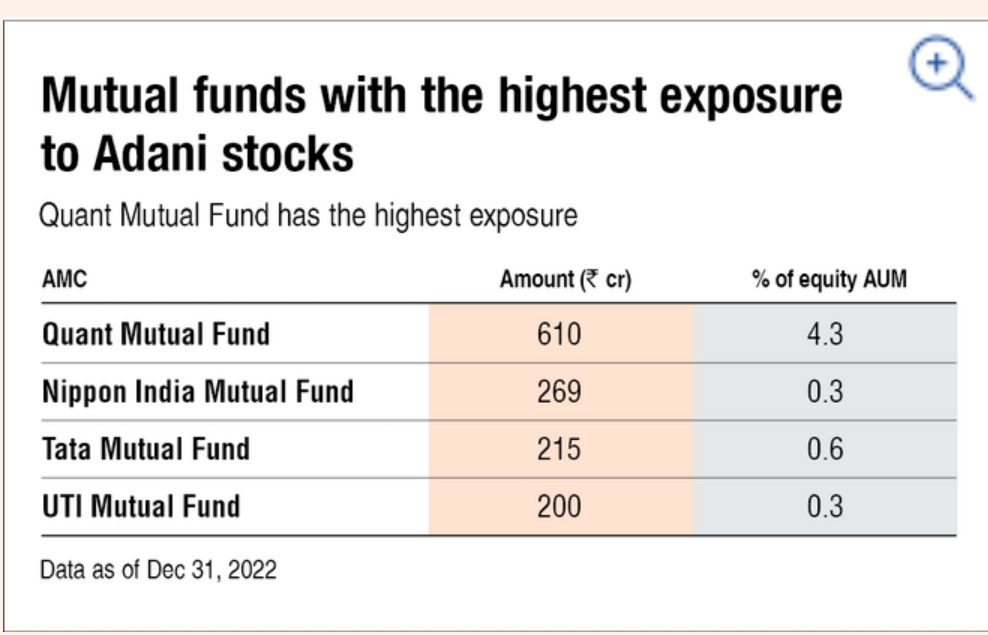

Fund houses that have invested the most in the Adani group

Quant Mutual Fund, Nippon India Mutual Fund, Tata Mutual Fund, and UTI Mutual Fund have the highest exposure to Adani stocks.

We at Wealth Pyramid Consulting, Always Focused on Quality portfolios instead of Value portfolios hence We almost have marginal exposure for a few Clients and 90% of the clients have almost 0 or limited exposure.

So be rest assured your mutual fund schemes are the safest.

Regards

Team Wealth Pyramid.